This Digital Asset Infrastructure from Africa Has Processed Over $3.5 Billion and Is Rapidly Gaining Global Traction

How Arrel enables institutions to run compliant stablecoin payments and lets asset managers control their full digital asset portfolio from one interface or one integration.

PORT LOUIS, MAURITIUS, November 18, 2025 -- In the race for traditional institutions to adopt digital asset technologies, one African company is emerging as a key enabler for financial institutions worldwide.

Arrel provides a non-custodial orchestration layer that helps banks, fintechs, and asset managers connect custody, compliance, and liquidity through a single API.

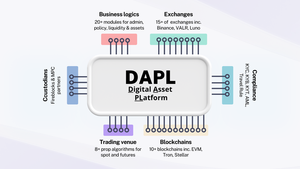

Built on its core Digital Asset PLatform (DAPL), Arrel integrates leading custody partners like Fireblocks, compliance providers such as Chainalysis and Sumsub, and liquidity from more than 15 exchanges. Institutions use it to automate treasury operations, FX, and stablecoin settlements across multiple blockchains and fiat rails.

Arrel's infrastructure has already processed more than $3.5 billion in digital asset execution and flows, proving its reliability and scalability at an institutional level. Clients have reduced launch times from nine months to a few weeks while ensuring full regulatory alignment.

Arrel is introducing two advanced platforms powered by DAPL, each designed to serve a distinct segment of the financial ecosystem: asset managers and payment providers.

AAMP (Arrel Asset Management Platform)

AAMP extends DAPL's core infrastructure to institutional asset managers, brokers, and funds. It enables complete visibility and control across portfolios, with integrated RFQ workflows, automated rebalancing, and compliance-ready reporting. Built for institutional-grade governance, it centralizes multi-exchange trading, liquidity access, and operational oversight within a single, auditable interface.

Arrel Pay

Arrel Pay delivers a stablecoin payment layer for businesses, PSPs, and merchants to accept, convert, and settle digital assets securely. It combines instant wallet creation, payment links, and KYT monitoring, direct exchange connectivity, and fiat off-ramps. Every transaction passes through automated compliance checks, ensuring fast, low-cost, and fully traceable settlements across blockchain and traditional banking rails.

Current international clients and sectors include:

Asset managers: Leverage Arrel through the API or through AAMP to offer digital assets to their clients while managing liquidity and trading across multiple exchanges from one venue.

Payment Service Providers: Integrate Arrel to accept payments in digital assets, verify transactions through KYT, and off-ramp securely to fiat in their local currencies.

Remittance providers: Leverage Arrel to enable fast and compliant cross-border transfers using stablecoins.

Banks and financial institutions: Adopt Arrel to settle stablecoin transactions and automate blockchain-based treasury operations with full compliance oversight.

This range of clients reflects how Arrel's modular infrastructure adapts to diverse financial and payment scenarios.

Additional use cases include:

- Cross border payments that settle within seconds across fiat and blockchain networks

- Institutional liquidity aggregated from multiple exchanges through one connection

- KYC, AML, Travel Rule, and KYT compliance module embedded into every transaction

- Compliant wallets, yield products, and tokenized portfolios deployed instantly

From Africa to global markets, Arrel is positioning itself as the orchestration layer that allows institutions to move from concept to execution in digital finance.

To date, Arrel has raised $1.4 million across two angel rounds and a grant. The company secured $670,000 and $580,000 in November 2017 and March 2023, respectively, followed by a $150,000 grant from the Stellar Development Foundation in September 2025 to support its expansion into stablecoin payments and liquidity automation on Stellar.

About Arrel

Arrel is a leading provider of institutional-grade digital asset infrastructure, enabling businesses to seamlessly integrate cryptocurrency and blockchain technology into their existing operations.

Our comprehensive platform combines custody, trading, compliance, and payment processing capabilities through a unified API, making it easier than ever for institutions to enter and operate in the digital asset space.

With deep expertise in both traditional finance and cutting-edge blockchain technology, we bridge the gap between legacy systems and the future of digital assets.

Request a demo at support@arreltech.com

# # #

Contact Information

Nicholas AllenArrel

Port Louis, Port Louis District

Mauritius

Voice: +27835791635

Website: Visit Our Website

Disclaimer